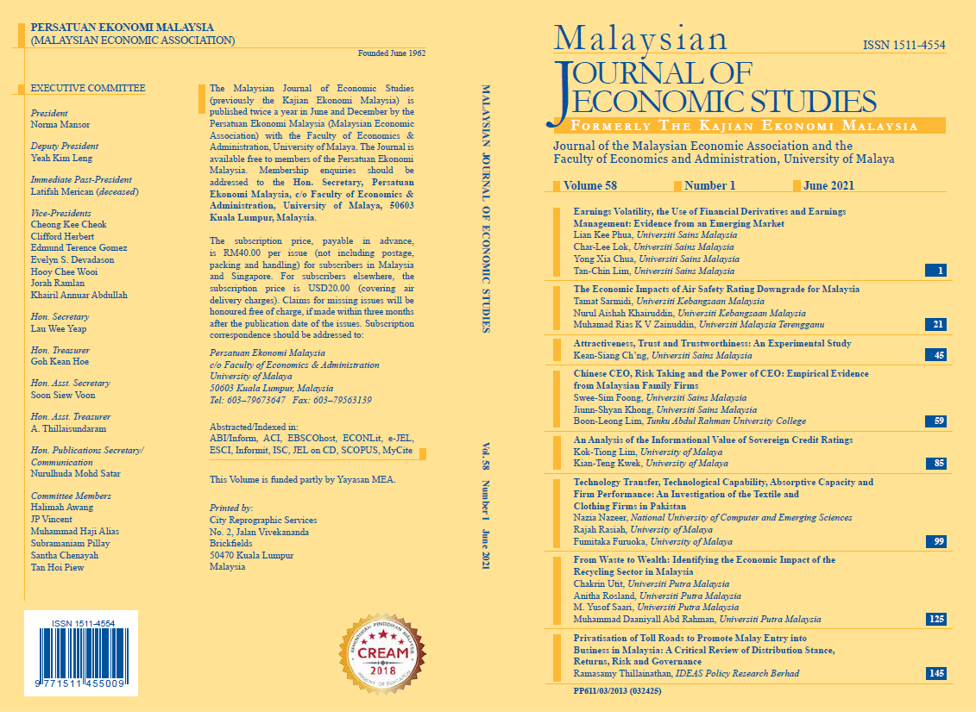

Chinese CEO, Risk Taking and the Power of CEO: Empirical Evidence from Malaysian Family Firms

DOI:

https://doi.org/10.22452/MJES.vol58no1.4Keywords:

CEO power, Chinese CEO, corporate governance, risk takingAbstract

This paper examines the risk taking behaviour of Chinese CEO. Our analysis is based on a sample of 362 family firms in Malaysia over the 2009-2015 period using panel GMM methodology. Firstly, our results offer evidence that Chinese CEOs are risk taking. We then examine how CEO power, in the context of Finkelstein’s (1992) structural power, ownership power, expert power and prestige power, might drive risk taking of Chinese CEOs. The results are rather mixed where greater ownership power is likely to promote higher risk taking but greater expert power resulted in lower risk taking. We further show that corporate governance can mitigate risk taking of Chinese CEO in family firms. When the proportions of independent directors and foreign institutional shareholdings exceed the median thresholds of 40% and 5%, respectively, we find that CEO risk taking behaviour turns from positive to negative. Stronger evidence is found when we adjust the thresholds to the 75th percentile of 50% and 15%, respectively. The result is also robust with the use of leverage as a measure for CEO risk taking.