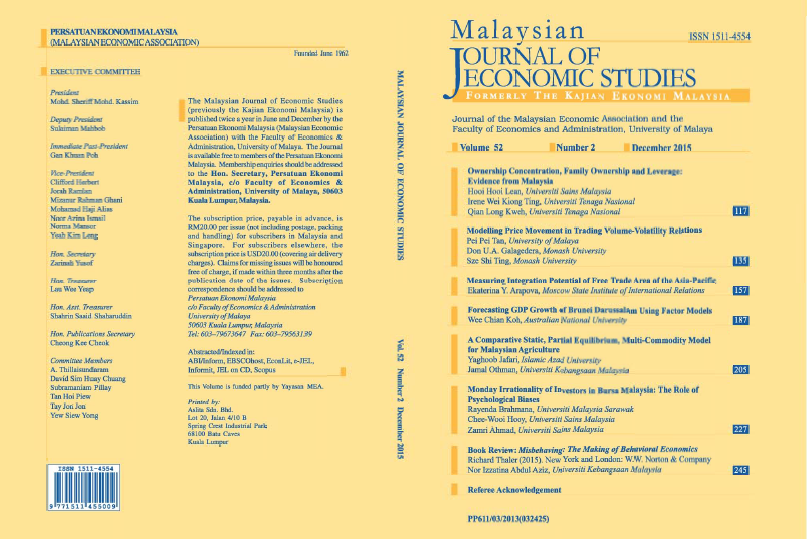

Modelling Price Movement in Trading Volume-Volatility Relations

Keywords:

Conditional volatility, GARCH-type models, price movement, trading volume, volatility persistenceAbstract

This study investigated the association between volatility of stock returns and price movement-induced trading volume. In the trading volume and volatility relation, we modeled price movement using indicator variables and coupled them with trading volume. In a sample of Australian stocks, we found that upward price movement-induced trading volume was likely to affect conditional volatility more than downward price movement-induced trading volume. Evidence of this asymmetric effect was stronger in the case of price movement over the trading period than in price movement over the non-trading period. This association was observed even after controlling for asymmetry of news in the previous period.

Downloads

Download data is not yet available.