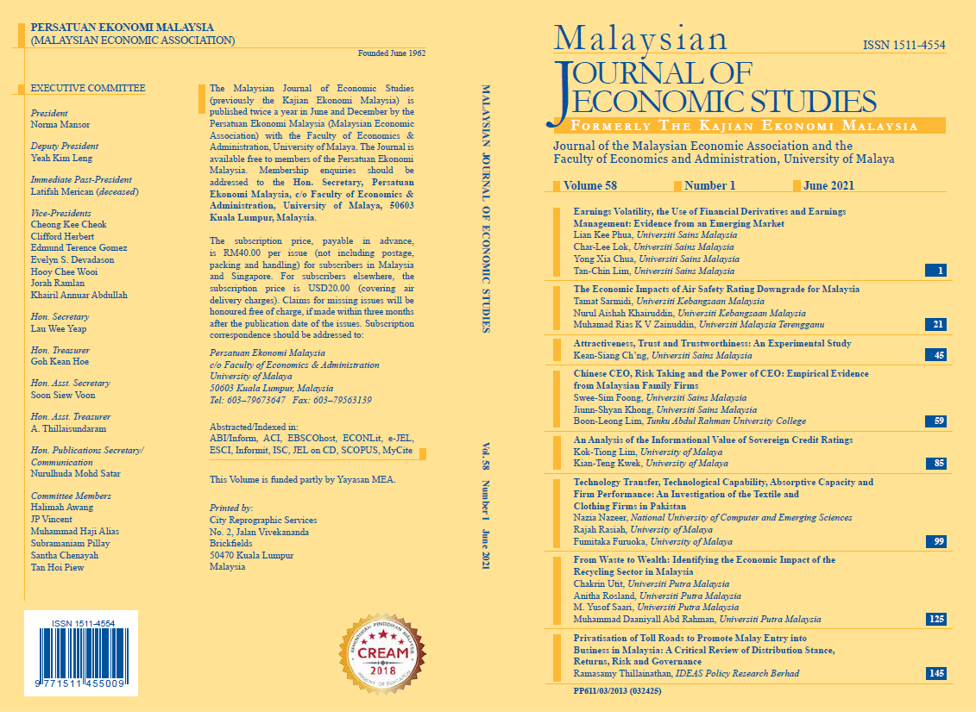

Earnings Volatility, the Use of Financial Derivatives and Earnings Management: Evidence from an Emerging Market

DOI:

https://doi.org/10.22452/MJES.vol58no1.1Keywords:

Derivative use, discretionary accruals, earnings management, earnings volatility, risk managementAbstract

In the face of crises such as Covid-19, businesses become devastated by greater risk exposure, particularly in currency exchange, supply chain disruption, and fluctuation in commodity prices that cause volatile earnings trends. Higher earnings volatility is frequently associated with greater risk. Consequently, firms could be inspired to engage in earnings management or derivative use as attempts to mitigate earnings volatility. Using a sample of 169 of the largest non-financial firms with 507 firm-years observations from an emerging market, the researchers examined the relationship among derivative use, earnings volatility, and earnings management. The results of a panel regression analysis showed that derivative use by Malaysian public listed companies was positively connected with earnings volatility, inferring that the use of derivatives did not mitigate earnings volatility as intended. This study also found that both earnings volatility and derivative use have a positive relationship with earnings management. This implies that firms engage in earnings management to curb earnings volatility under circumstances where derivative use is associated with higher earnings volatility. Evidence derived from this study contributes to extant literature on financial risk management involving financial instruments, an area that is very much understudied in the contexts of emerging markets.